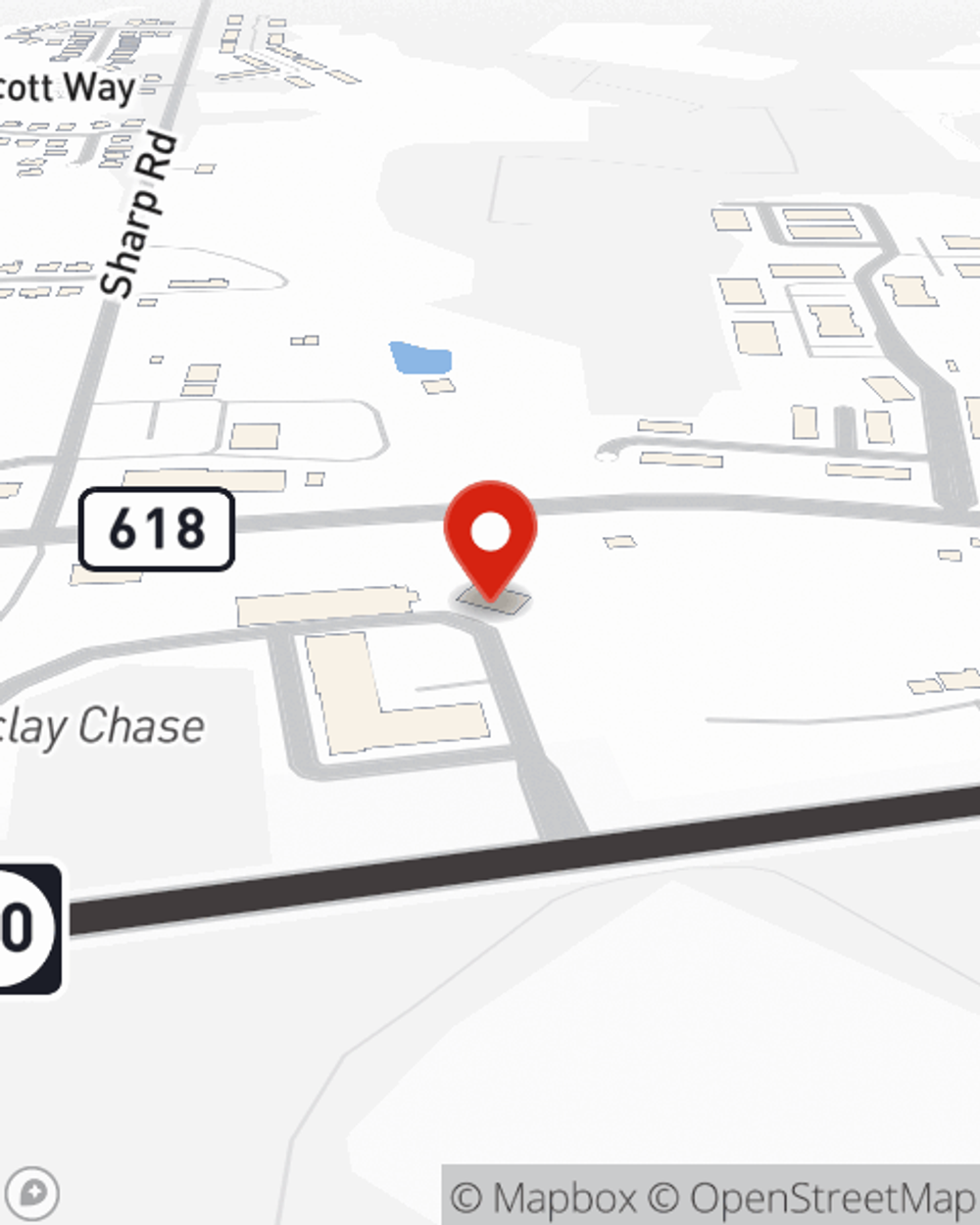

Business Insurance in and around Marlton

One of the top small business insurance companies in Marlton, and beyond.

Insure your business, intentionally

Cost Effective Insurance For Your Business.

As a business owner, you have to think about all areas of business, all the time. The details can be overwhelming! You can save time by working with State Farm agent Chris Johnson. Chris Johnson relates to where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your concerns and frees you to focus on growing your business into the future.

One of the top small business insurance companies in Marlton, and beyond.

Insure your business, intentionally

Protect Your Future With State Farm

If you're looking for a business policy that can help cover equipment breakdown, loss of income, and more, State Farm may be able to help, just like they've done for other small businesses since 1935.

It's time to call or email State Farm agent Chris Johnson. You'll quickly find out why State Farm is one of the leading providers of small business insurance.

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Chris Johnson

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.